The US Dollar (USD) is currently experiencing a significant downturn, marking its most substantial first-half decline in almost four decades, as per Bloomberg statistics cited by SMM.

Although the reelection of US President Donald Trump was initially perceived as beneficial for the US Dollar, recent events suggest otherwise: erratic trade policies, escalating fiscal deficits, and a reduced international demand for US Dollar-denominated assets are exerting pressure on the currency.

Is this downturn merely a temporary setback, or does it signify a fundamental shift away from the dominance of the US Dollar?

Unprecedented Downturn for the US Dollar

The ongoing decline of the US Dollar is notable for its rapidity and magnitude. The US Dollar Index (DXY), which tracks the currency against a group of six international currencies, has plummeted over 10% since the year’s start, falling to around 97 points, a level last seen in February 2022. This represents the DXY’s weakest performance for a first half in decades.

US Dollar Index H1 performance. Source: FXStreet

The movement extends beyond the currency markets, reflecting a major reshuffling of global capital flows amid ongoing political and economic uncertainties in the United States.

“The foreign exchange market dynamics directly mirror a crisis of confidence in the fundamental economic stability and governance of the US,” explains Barry Eichengreen, a professor of economics at UC Berkeley.

The Contradictory Impact of Trump’s Policies

Initial anticipations of a stronger US Dollar were founded on two main aspects of President Trump’s strategies: fiscal stimulus through tax reductions, and trade tariffs intended to improve the trade balance. However, these actions have produced the opposite effect.

The erratic nature of tariff announcements – whether they are implemented, postponed, or extended – has heightened market volatility and deteriorated the investment environment. The uncertainty stemming from US trade policies has also lessened the attractiveness of the US Dollar as a safe-haven asset.

“The traditional safety premium associated with Dollar-denominated assets is experiencing a significant decline,” states Francesco Pesole, an FX strategist at ING.

“The Dollar’s reputation as a safe-haven currency is now under scrutiny,” he adds.

Shift in Capital Flows

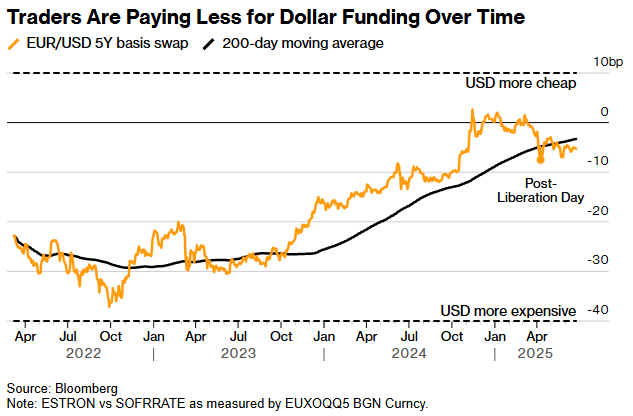

One significant change involves cross-border capital flows. Several indicators, such as the cross-currency basis swap, indicate a decreasing demand for US Dollars internationally, favoring currencies like the Euro (EUR) and the Japanese Yen (JPY).

According to Goldman Sachs and BNP Paribas, European institutional investors, particularly pension funds and insurers, have significantly reduced their US Dollar holdings, as reported by SMM. Concurrently, China has increased its sales of US Treasuries, further diversifying its reserves.

“We are observing a systemic shift towards markets perceived as more stable from a macroeconomic perspective. This signifies a paradigm change in the perception of sovereign risk,” remarks Richard Chambers, Global Head at Goldman Sachs.

Rising Concerns Over Structural Imbalances

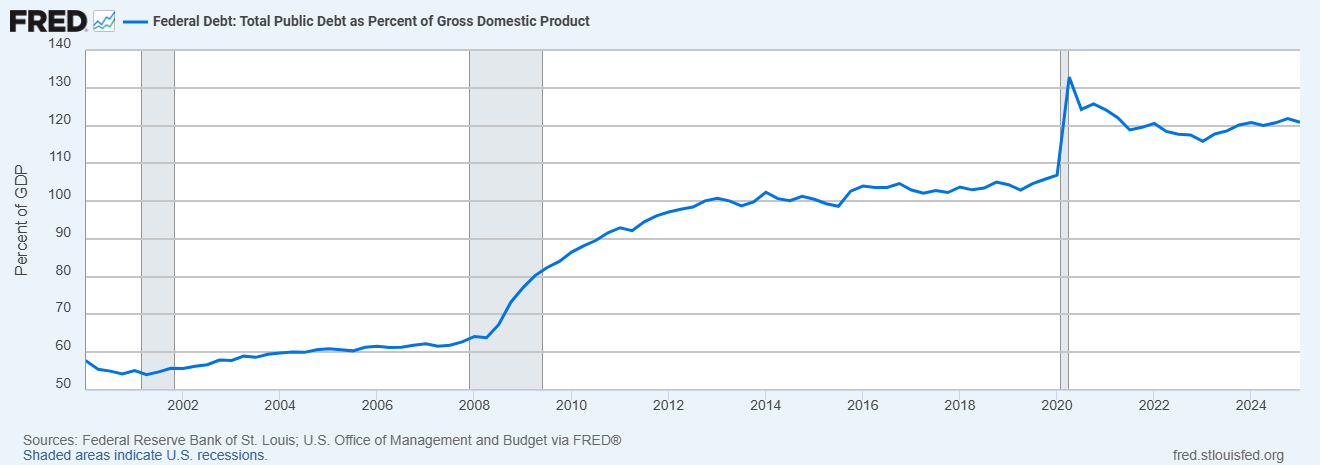

This trend is exacerbated by worries regarding the US’s fiscal path. The national deficit now surpasses 6.8% of GDP, with federal debt nearing $36,200 billion, or more than 120% of GDP, according to data from the Fed.

In light of these factors, investors are demanding higher yields to finance US debt, thereby increasing the cost of both government and private sector financing.

Accelerating Global Rebalancing

The decline in the DXY has benefited several currencies:

- The Euro has surged by 13% since January, reaching levels not seen since 2021.

- The Japanese Yen, Swedish Krona (SEK), and Swiss Franc (CHF) have also seen substantial gains during this period.

- In Asia, the Taiwanese Dollar (TWD), Korean Won (KRW), and Thai Baht (THB) have appreciated by between 6% and 12%.

These trends reflect a shift in perceptions regarding the relative economic stability of different regional blocs and an increased anticipation of future currency divergences.

Outlook for the Second Half of the Year

The US Dollar’s decline during the first half of the year occurred despite the Federal Reserve maintaining high interest rates. However, this trend may not persist: the Fed is expected to make up to three rate cuts by year-end, as per market forecasts, while inflation, measured by the PCE index (2.3% in May), is nearing the Fed’s target of 2%.

Without significant adjustments in deficit reduction or trade stabilization policies, the US Dollar may continue to depreciate in a steady yet prolonged manner.

“Given the current conditions, there’s a strong case for a continued weakening of the US Dollar, unless there’s a major overhaul in US fiscal policy,” suggests Arun Sai, a multi-asset strategist at Pictet AM.

A Critical Turning Point for the US Dollar

The decline of the US Dollar in 2025 transcends a mere market correction. It signifies a strategic realignment by global investors and a reevaluation of the fundamentals that have traditionally underpinned the currency’s central role.

While the US Dollar remains a dominant force, its systemic influence may gradually diminish if the current challenges, including political instability, fiscal imbalances, and a loss of monetary credibility, are not swiftly addressed.

Leave a Comment