- Gold Prices Soar to Five-Week High Amid Geopolitical Tensions and Dovish Federal Reserve Outlook

- Gold Climbs as Israel-Iran Conflict Escalates, Spurring Safe-Haven Demand

- Gold (XAU/USD) Peaks at $3,446, Eyes on Upcoming Federal Reserve Decision

Gold prices surged for the third consecutive day following the outbreak of conflict between Israel and Iran, which sparked a flight to safety among investors. At present, XAU/USD is trading at $3,422, marking an increase of over 1%.

The rise in gold prices was notably influenced by Israel’s military actions against Iran, which heightened regional tensions. Following these events, gold reached a five-week peak of $3,446, then slightly retreated as traders took profits before the weekend.

US Inflation Data Influences Federal Reserve Rate Expectations

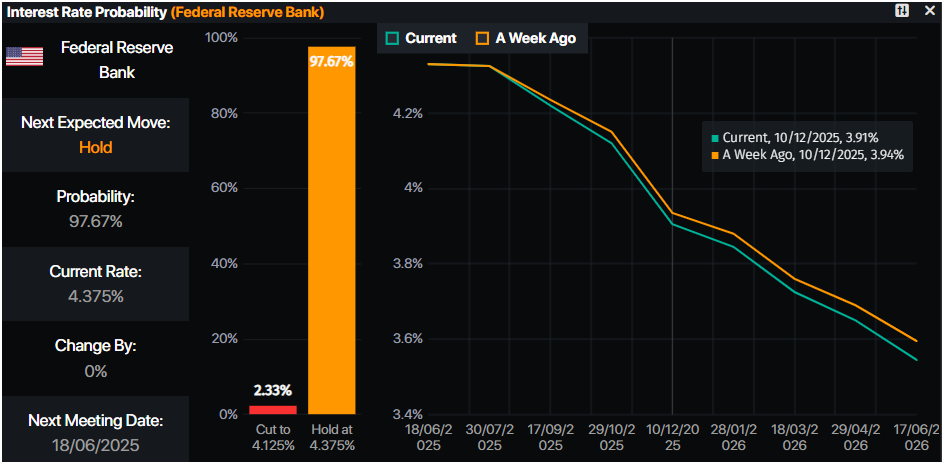

The easing of inflation in the US, as indicated by recent CPI and PPI reports, alongside improving consumer sentiment reported by the University of Michigan, supports the possibility of upcoming Fed rate cuts.

Amid these developments, US President Donald Trump commented that the Iranian government had provoked the attacks, while the US had previously urged Iran to curb its nuclear ambitions.

Investors are now keenly awaiting the Federal Reserve’s next meeting, where economic projections will be updated, and additional US economic data will be released, potentially influencing the direction of gold prices.

Market Movers: Gold Prices React to Geopolitical Risks and Economic Data

- President Trump suggested to Axios that the conflict might facilitate negotiations with Iran, emphasizing the urgency to end the violence.

- The recent UoM Consumer Sentiment report reflects growing economic optimism among US households, despite ongoing inflation concerns.

- While positive economic data might support a more dovish Fed policy, the escalation in the Middle East has pushed oil prices up significantly, hinting at potential inflationary pressures.

- Recovery in US Treasury yields and a strengthening US Dollar are putting pressure on gold prices, limiting their gains.

- Despite recent fluctuations, financial analysts from Goldman Sachs and Bank of America forecast significant rises in gold prices over the coming years.

- Market speculation suggests expectations of monetary easing by the end of the year, as indicated by money market data.

Source: Prime Market Terminal

Technical Analysis: Gold Price Near $3,400 with Bullish Momentum

The technical outlook for gold remains positive, with potential for the price to exceed $3,450 and test the record high near $3,500. However, should prices drop, support levels to watch include $3,400 and the 50-day SMA at $3,281.

Leave a Comment